The Best Strategy To Use For Electronic Financing

Also, additionally's below to select each option. If you want to sign for a debit card transaction, you normally swipe your card with the visitor and pick "credit scores" even though you are authorizing a debit (withdrawal) from your account, not a credit score card purchase.

Some Known Details About Electronic Financing

Right here's just how to avoid ending up being a target: Never create your PIN on or near your card. Don't provide out financial institution account information over the phone or the Web unless you have actually initiated the get in touch with or you recognize the person is who he or she asserts to be.

"Don't drop for it," stated Cardamone. "A true agent of your financial institution will certainly never ever require to ask for your PIN because your bank already has your account info. Don't share your debit card PIN, safety code and also various other account info with pals or family members that aren't co-owners of your account.

"Typical frauds start with a task offer or a Web relationship or love that leads to pleas for money transfers and secrecy," stated David Nelson, an FDIC scams expert. Take safety measures at the checkout counter, ATM and gas pump. Constantly stand to make sure that no person can see the keypad where you enter your PIN.

4 Easy Facts About Electronic Financing Explained

Professionals recommend mounting and also regularly upgrading infection and spyware defense and a "individual firewall program" to stop thieves from privately setting up malicious software on your computer remotely that can be used to snoop on your computer system usage as well as acquire account information. Consider your financial institution statements as quickly as they show up.

Bear in mind that with a debit card, the cash tapped by the thief has already been taken out of your account. Under the EFTA, a financial institution has 10 company days to check out the matter (20 company days if your account is brand-new) and record back to you with its outcomes.

Typically, a financial institution is permitted as much as 45 days of extra investigation time (90 days for sure purchases). "Yet until the conflict is dealt with," stated Creamean, "you should be prepared to pay your home loan, vehicle repayment, credit rating card expense and also any other responsibilities that may come due." Likewise, she claimed, if the financial institution's examination finds there was no mistake, theft or loss, it can reclaim the cash it took into your account, after informing you.

Some Known Factual Statements About Electronic Financing

With this support, the capacity of existing financing options can be totally unlocked. Stakeholders will be able to witness the decarbonization impacts induced by power performance upgrades, and also they will certainly have reward to explore innovative funding options for much more difficult energy efficiency circumstances.

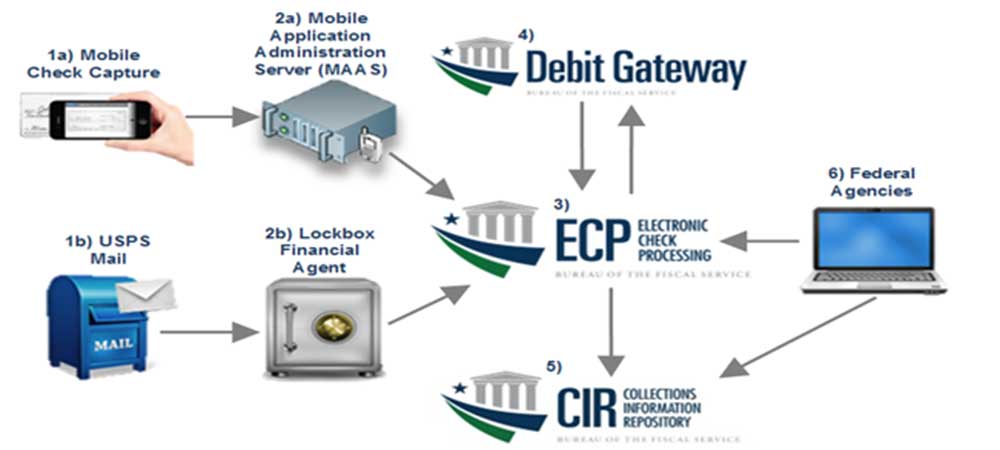

Was it utilizing an electronic wire transfer? That's one possible electronic financial service he used. This refers to a network where economic deals going from one bank account to another are transmitted online, as opposed to literally.

Electronic Financing - The Facts

Using an atm machine or automated bank employee machine is an electronic economic service. That's due to the fact that the ATM has to digitally confirm John has sufficient funds in his checking account to take out the $100. It then digitally records that he took out $100 from his account. There is no physical person doing this! John then goes to the shop to grab some products for his service.

So, he uses his debt card to purchase the materials. Right here, he makes use of several electronic economic solutions in various means: His charge card was used to acquire something online. The charge card purchase was implemented using digital economic services as John never physically paid any type of cash money for anything. John will certainly pay his bank card business using his on-line account too, yet another digital economic service.

The Main Principles Of Electronic Financing

In really basic terms, if you ever buy, offer, or access any kind of form of monetary solution essentially-- rather than physically, such as strolling right into a financial institution-- you have actually utilized an electronic monetary service (electronic financing). Even when you pay for things personally, they might depend heavily on digital economic solutions.

March 27, 2022 Concern Brief Passion rate restrictions are the easiest and also defense versus predative lending. Since the time of the, states have actually restricted interest prices to safeguard their locals.

More About Electronic Financing

Lenders choose where they provide, generally staying clear of states that vigorously apply why not try here their laws. See listed below to discover the financial institutions and also loan providers collaborating to release triple-digit rate of interest, debt-trap fundings in states that do not enable high-cost lendings as well as which specifies they stay clear of. in or on this to see the amount of "rent-a-bank" lenders are attempting to avoid price caps in your state.

Upgraded Feb. 14, 2022 Opp, Fundings (aka Opp, Fi) utilizes FDIC-supervised Fin, Wise Bank (Utah), Capital Area Financial Institution (CC Bank) (Utah), and First Electronic Bank, a Utah commercial bank, to make installment finances of $500 to $4,000 at in a number of states that do not enable that rate for some or all finances in that dimension range.

Comments on “Electronic Financing - Truths”